The Hidden Power of Protection:

Benefits of Term Life Insurance with Living Benefits

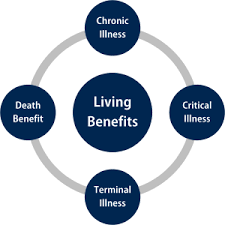

So, when people hear “life insurance,” many think of death benefits. Or payments to loved ones after they’re gone. Your policy can offer support while you’re still living? Welcome to the world of term life insurance with living benefits. It’s a powerful yet often overlooked financial tool.

What Is Term Life Insurance with Living Benefits?

Term life insurance provides coverage for a set period—typically 10, 20, or 30 years. Then, if you pass away during that term, your beneficiaries receive a lump sum payment. It’s affordable, popular among families and young professionals. Yet, 99% of term policies never payout. Most people can’t afford the next term. Others, no longer feel the need for the term insurance when the term period ends. Living benefits, also known as accelerated benefit riders, change the picture. How do they do that? They allow you to access a portion of your death benefit while you’re still alive if you’re diagnosed with certain serious illnesses or conditions. Here’s an example: https://www.youtube.com/watch?v=e7t0B2oDPWE

Are there drawbacks to Living Benefits? Sure there are. In order to pay for certain illnesses or conditions your death benefit will be reduced. In some cases, this may leave only a small amount for burial expenses.

————————————————————————————————————————————————————————————————————————————

Key Benefits of Term Life with Living Benefits

I. Protection Beyond Death

A big advantage is you don’t have to die for the policy to help you. If you’re diagnosed with a qualifying illness (like cancer, heart attack, stroke, or a chronic condition). You can access part of your death benefit to cover:

Medical bills

In-home care

Rehabilitation expenses

Lost income

Cover Mortgage costs

Travel for treatment

II. Financial Flexibility During a Health Crisis

Living benefits give you the option to tap into funds exactly when you need them most—during a health emergency. Instead of draining savings or retirement funds, your policy becomes a financial cushion that buys time, care, and peace of mind.

III. Affordability

Despite offering extra protection, term life with living benefits is still remarkably affordable, especially when compared to whole life or other permanent insurance policies. You get more value from your premium dollars while locking in rates for the duration of your term.

IV. Peace of Mind for You and Your Family

Knowing that you have a safety net for both unexpected death and serious illness provides deep emotional reassurance. You’re not just protecting your family after you’re gone—you’re protecting your future together.

V. No Restrictions on How You Use the Money

One of the best aspects of living benefits is that the money is yours to use however you choose. Whether it’s paying for alternative treatments, modifying your home for accessibility, or covering daily living expenses, there are no limitations or oversight.

Real-Life Example: Why It Matters?

Suppose you’re 38, with two kids, working full-time. Suddenly, you’re diagnosed with early-stage cancer. With living benefits, you can access $100,000 of your $500,000 death benefit. Then, you can take time off work. Pay for treatments not covered by insurance, and keep your household afloat without financial strain.

This kind of flexibility can be life-changing—not just for you, but for your entire family.

Is It Right for You?

If you’re healthy and looking for affordable life insurance. Term life with living benefits is a smart option. It’s especially valuable:

* If you have dependents relying on your income?

* Do you want extra coverage for unexpected illnesses?

* Will you have long-term disability insurance?

* Is peace of mind without breaking the bank important to you?

Final Thoughts

Term life insurance with living benefits is more than a death benefit. It’s a living safety net. You have control, dignity, and financial support when you need it most. In a world full of uncertainty, it’s one of the tools that offers protection for both the “what ifs” and the “what nows.”

✅ Take the First Step Today

Don’t wait for a crisis to realize the importance of the right coverage.

Get a free quote or schedule a consultation with a licensed insurance expert today to explore term life insurance with living benefits. It’s fast, simple, and could make all the difference—for you and those you love.

👉 Contact me at Michael@MELFinServices.com or fill out the FIF Form to get your free quote today.