Market Crashes: Fear, Fallout, and Finding a Way Forward

The stock market can be like a roller coaster—thrilling on the way up, terrifying on the way down. However, a stock market crash isn’t just screen numbers falling. Future retirement dreams are frozen, college savings vanish, businesses shutter, and families wonder how they’ll make it through tomorrow.

One day, the headlines are full of optimism: “Markets at Record Highs.” The next, panic grips the world as red numbers dominate the news ticker. In a matter of hours, fortunes vanish. For many, it feels like the ground beneath them has given way. It is a part of the process of a healthy market as it tries to wring out excess valuations. There are 4 stages to the market cycle. Here’s a link to a helpful video starting at 1:44 (https://www.youtube.com/watch?v=Qf-0OFHJZCg)

Stage 1: Consolidation or Basing stage. This happens after a significant downtrend. This occurs around the 200-day moving average. Volume is typically low as institutions accumulate shares quietly.

Stage 2: Accumulation (Markup) This is index or stock breaking out of a stage 1 trading range with heavy volume entering a strong uptrend. This is marked by higher highs and higher lows. Prices rise above the 50 and 200 day moving averages.

Stage 3: Distribution – After a substantial move, the stock or indexes momentum fades, and enters a topping or climax run. Prices swing wildly in either direction. Volume often increases on the selling side as institutions sell shares to less-informed retail investors.

Stage 4: Capitulation (Downtrend) This is the final and most dangerous stage, marking a clear downtrend. Prices lose support and fall below the 200-day moving average. Evidenced by lower highs and lower lows. Therefore, fear and panic selling take hold. Instead of climax buying, fear turns to climax selling.

Remember, behind every statistic are real lives:

-

A couple watches their nest egg cut in half.

-

A business owner forced to lay off loyal employees.

-

Young professionals, just starting to invest, question if the system is rigged against them.

A crash is not just an economic event—it’s deeply human.

Why Crashes Happen

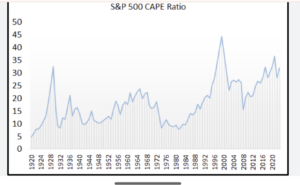

In every crash is a story of imbalance. So, greed inflates bubbles. Then, fear pops them. Whether it’s reckless speculation, economic shocks, or global crises, the result is the same. Hence, trust in the market shatters, and panic spreads like wildfire. Most crashes center around recessions as consumers reign in their spending. Also, it may be caused by the Federal Reserve waiting too long to reduce interest rates. Mel Financial Services continues to educate clients on current market conditions. Then, how to prepare their accounts when times change. Daily, we produce a market report based upon this educational approach. As the market turns, we will be there to provide insight and action steps. Business Insider last week saw the Shiller index below is near all time highs, not seen since the Dotcom era.

The Ripple Through Society

Crashes don’t stop at Wall Street. They reach Main Street too. That’s where people feel poorer, they stop spending. When businesses lose confidence, they stop hiring. Jobs disappear. Dreams get delayed. Families tighten their belts. And, a crash reminds us how interconnected money, markets, and our everyday lives really are.

What Crashes Teach Us

Every crash is painful—but also revealing. They teach us:

-

We can’t control the market, but we can control our reactions. Panic selling deepens losses; patience gives recovery a chance.

-

Diversification is protection. Those who spread risk across different investments weather storms better.

-

Resilience is everything. Besides, history shows markets recover, often stronger than before. Those who endure often come out ahead.

Feel free to check out the videos https://www.melfinservices.com/videos/

Moving Forward With Hope

In a crash, it may seem easy to feel powerless. But, remember—markets have always bounced back. From the Great Depression to the 2008 financial crisis, recovery followed every collapse. Although the pain is real, so is the rebound. This is why we recommend diversifying into permanent life insurance or fixed indexed annuities. Both programs offer protection from market declines. Accordingly, this protection works because the account isn’t directly invested in the market. In effect, the account value goes up when the market goes up, it stays flat when the market retreats. Every 8-10 years there is a significant pullback in markets. By having an annuity in your portfolio, one could have avoided a 54% correction in markets in 2008.

For investors, families, and dreamers alike, the message is clear: a crash is not the end of your story. It’s a chapter that tests your resolve, sharpens your strategy, and reminds you that wealth is not only measured in numbers. But, in resilience, patience, and having the right tools to meet your goals.