What Is a Life Insurance Settlement Investment?

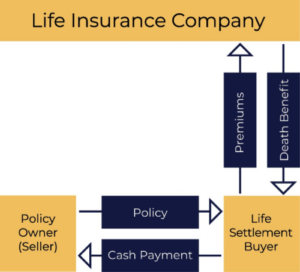

A life insurance settlement occurs when a policyholder sells an existing life insurance policy to a third party. The sale is a lump sum that exceeds the policy’s cash surrender value and less than the death benefit. The buyer assumes responsibility for future premium payments. Then the buyer receives the death benefit upon death of the insured. In California, Life Insurance agents can sell Life Insurance Settlements with a state life insurance license. Other states may have more regulations that requiring a

security license.

For more information refer to the article below:

https://www.finra.org/investors/insights/what-you-should-know-about-life-settlements

For the investor, the transaction converts the insurance policy into a financial asset. It has a defined payout and an uncertain timing component.

How Do Investors Participate

Investors can access life insurance settlements through:

I. Direct policy purchases, usually reserved for institutional or high-net-worth investors

II. Life settlement funds, which pool multiple policies to diversify longevity risk

III. Structured products or private placements, often managed by specialized firms

Once invested, the investor pays ongoing premiums and receives the death benefit upon maturity of the policy. For more information on how to sell your life insurance policy – https://www.melfinservices.com/life-insurance-settlements/

Why Investors Are Interested?

Life insurance settlements offer several characteristics that appeal to investors seeking diversification:

I. Low correlation to traditional markets

Returns are independent of stock market performance, interest rates, and economic cycles.

II. Predictable payout value

The death benefit is contractually defined, unlike many other alternative assets.

III. Attractive risk-adjusted returns

If policies are priced accurately and managed well, life settlements offer competitive yields relative to other fixed-income or alternative investments.

IV. Demographic tailwinds

An aging population and rising longevity awareness have expanded the supply of policies available for settlement.

What Are Key Investment Risks?

Despite their appeal, life insurance settlements are not risk-free. Here are the Risks:

I. Longevity risk

If the insured lives longer than expected, premium payments increase and returns may decline.

II. Premium sustainability

Rising premiums or underestimating future costs can materially impact profitability.

III. Liquidity constraints

Life settlements are typically illiquid. Investors may need to hold policies for many years.

IV. Regulatory complexity

Life settlement markets are regulated at the state level in the U.S., and compliance requirements vary widely.

V. Valuation uncertainty

Accurate medical underwriting and life expectancy estimates are critical—and imperfect.

Ethical and Reputational Considerations

Investing in life insurance settlements can raise ethical questions. Since returns are tied to mortality. Industry participants emphasize consumer protections and transparency. Because policyholders benefit by receiving value from policies they no longer need or can afford. Reputable investment managers adhere to strict regulatory and ethical standards to mitigate reputational risk.

Due Diligence Essentials

Before investing, thorough due diligence is essential. Key questions include:

I. How are life expectancy estimates obtained and validated?

II. What assumptions are used for premium projections?

III. How diversified is the policy pool?

IV. What fees and expenses are involved?

V. How experienced is the investment manager in policy servicing and compliance?

Who Should Consider Life Insurance Settlements?

Life insurance settlements may be appropriate for:

I. Institutional investors seeking portfolio diversification

II. High-net-worth individuals with a long-term investment horizon

III. Investors comfortable with complex, illiquid assets

They are generally unsuitable for investors requiring short-term liquidity or low-risk capital preservation.

Conclusion

Life insurance settlements represent a distinctive alternative investment with the potential for stable, uncorrelated returns. However, success in this asset class depends heavily on disciplined underwriting, conservative assumptions, regulatory expertise, and long-term capital commitment. Investors willing to navigate these complexities, life insurance settlements play a valuable role in a diversified portfolio.

For more information, please contact us at 510-831-4754, or email: michael@melfinservices.com