Tax Planning: Maximize and Maintain Wealth

When people or small businesses think about taxes, they often picture filing paperwork in April or scrambling to find last-minute deductions. But effective Wealth Management involves tax planning that goes far beyond preparing a return. Tax Planning involves year-round planning. This helps individuals and businesses minimize liabilities. Also, this maximizes savings, and aids in smarter financial decisions.

What is Tax Planning?

Tax planning is the process of analyzing your financial situation. Then structuring so that it reduces your tax burden, and remaining compliant with the law. The plan is not about avoiding taxes—it’s about being proactive and intentional so you can keep more of what you earn.

Why Tax Planning Matters

-

Keep More Money in Your Pocket – By taking advantage of deductions, credits, and tax-advantaged accounts, you reduce your taxable income.

-

Supports Long-Term Goals – Strategic planning aligns taxes with retirement, education, or wealth-building goals.

-

Reduces Surprises – Instead of being caught off guard with a large bill, you’ll know what to expect.

-

Ensures Compliance – Staying ahead of tax law changes helps avoid costly penalties or audits.

Key Tax Planning Strategies

1. Maximize Retirement Contributions

Contributing to retirement accounts like 401(k)s, IRAs, or SEP IRAs (for business owners) not only builds long-term wealth but also reduces taxable income today. There are other programs that can reduce taxes of up to $430,000 for business owners. This money can then be directed to retirement planning.

2. Use Tax-Advantaged Accounts

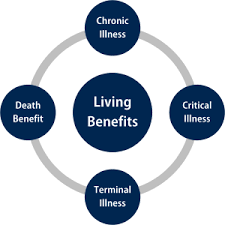

Health Savings Accounts (HSAs) and 529 education plans allow you to save for medical expenses or education while receiving tax benefits. Permanent Life Insurance plans also can provide tax benefits in case of Chronic, Critical or Terminal illnesses.

3. Plan Charitable Giving

Donations to qualified charities may provide deductions. Bundling donations in one year (rather than spreading them out) can increase tax efficiency.

4. Manage Investments Strategically

Harvesting investment losses, holding investments longer for favorable capital gains rates, and choosing tax-efficient funds can all reduce taxes.

5. Understand Business Deductions

For business owners, deductions for expenses like equipment, travel, or home offices can significantly reduce taxable income—when tracked properly.

When to Start Tax Planning

The best time to start tax planning is now. Businesses should consider having a Tax Coach plan monthly Tax calls. Waiting until tax season often means missed opportunities. Regular reviews throughout the year—especially after major life events like buying a home, starting a business, or retiring—ensure your strategy stays aligned with your goals. Alignable and Linkedin can be good sources to find reliable tax preparers.

Final Considerations

Tax planning isn’t just for high-income earners or corporations. Whether you’re an employee, a small business owner, or someone nearing retirement, smart tax strategies can provide financial confidence and peace of mind. Working with a qualified tax professional ensures that your plan is tailored to your unique situation—and keeps you ahead of changing tax laws.

related news & insights.

Market Crashes