Can You Trust Government Numbers in an Election Year?

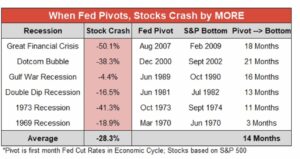

All of the stock investment indexes ended with hanging-man candlestick patterns on low volume with wide divergences above moving averages. Crypto currency investment signal a risk-off tendency as they lose their moxie. Historically, they don’t perform well ahead of recessions. Both the stochastics and CCI indicators are pointing markets downward. Just as we progress to the weakest market season – Fall leads to a fall in market prices.”Discernment” is what you need when the current administration manipulates initial numbers to make them look better. They adjust the numbers on Friday night when no one is paying attention. Retail Investment Sales number crushed estimates and still Dillard’s, Target, Walgreens, and Dollar General stocks crashed. If retail is doing so well shouldn’t those stocks not be crashing?? 7 out of the last 9 jobs reports were corrected downward as 818K jobs were erroneously reported. New Housing numbers are good but existing home sales are crashing. Home construction builders may have to reduce prices to move inventory. Good news for 1st home buyers but not so good for sellers. Trucking firms are slashing jobs as the economy slumbers along. All that being said, August proved to be a dress rehearsal for declining markets. Wedging in equity investing is when the move higher is on low volume, NVIDIA had a weak, low volume V shaped recovery with a triple top confirmation after its earnings. History has proven when the Fed pivots lower so does the market, the bigger the pivot, the bigger the markets fall. Beware!!