Is an Investors Crash Immanent?

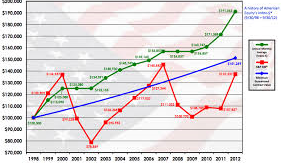

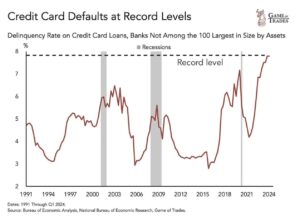

The stock market investment has its worst start to the month in over 40 years. A positive is that the bond index is no longer inverted. Danger signs are credit card delinquencies have hit new all-time highs. Non-farm jobs missed estimates by about 18K. June and July jobs were adjusted down. Cost of living is up 20% over the last four years. This compares to less than 7.8% vs. the prior four years.

With Government debt at highest levels ever, what can happen. Post 1929 investment crash was worse than the crash itself. The economy stagnated for a number of years after. Some are calling for a 4 year recession if a significant crash happens. What can happen to government sponsored (401k, 403B, TSP, Keogh) investment savings is what should frighten most. A severe sell-off is long overdue. 2020 didn’t ring out all of the excesses in the market because the Fed dropped helicopter money everywhere to stimulate the economy. Extreme levels of personal debt won’t allow many to weather a long recession. Now is the time to act. I’ve been advocating moving a portion of funds into fixed index annuity accounts that don’t fall when the market falls. 2008, 2022 should alert you to what could happen to your savings. 2008 fell 54%, 2022 bear market started in many small cap stocks in February of 2021, then the indexes started to fall around Thanksgiving and continued well into 2022. The market started to rebound in November of 2023.