This is an update to my blog a year ago. But is still relevant today. China equities are trending. BABA, FUTU, and others are moving higher. The Chinese Yuan rises on weaker dollar prospects and the stock market strength. https://www.tradingview.com/news/reuters.com,2025:newsml_L3N3VC0AL:0-china-s-yuan-rises-on-weaker-dollar-prospects-stock-market-strength/ The leading ETF’s in China are FXI and KWEB. KWEB is up 18% in 11 weeks whereas FXI is up 8% in the same timeframe. In comparison, the S&P 500 is up 7% in 14 weeks.

China investment equity prices surge as it reduces rates to support their financial markets. Their stock market over the past 10 years have been negative. The government controls the currency. They hope to create inflation. Their big goal is to sell their products to the US and Europe. So for the moment their equities are making big bounces. However, they do not have to follow the same investment financial transparency other markets follow.

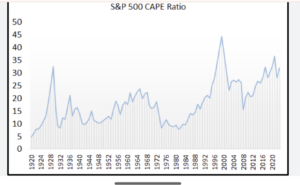

What does this mean for the US markets? The September rate cut was 25 basis points. Some are suggesting that there may another 25-50 basis point cut before the end of the year. The US Fed, like China, wants to create inflation just not at the levels it has been over the past 4 years. They are hoping for 2 to 2 1/2%. The mix in the ointment is oil reserves are at their lowest levels in years. With any demand pickup oil prices will surge creating higher inflation than anyone hopes for. The chart below shows the Shiller P/E ratio, a trusted stock-market guage, at its highest level since the dot com bubble. https://markets.businessinsider.com/news/stocks/stock-market-outlook-shiller-pe-ratio-dot-com-bubble-ai-2025-9

The markets are at highs now due to a falling dollar. There is great risk for a 10% or greater correction. Many individual investors are now on margin. Some of these equities could severely damage their portfolios as individual names can correct much more than 10% causing 20-40% damage or more to their accounts. As the saying goes, “the trend is your friend until it ends.”

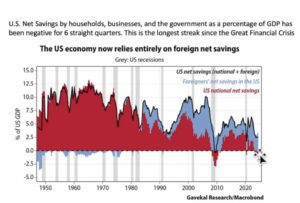

The chart below unsettling. My council is to remain vigilant and act quickly to any changes in the current investment trend. Selling into strength continues to be a wise move.